Keep in mind, if you are restoring a classic automobile it must be recovered utilizing the initial design and also components. Extra components protection, Classic automobile enthusiasts might have a couple of extra components for future upgrades. With extra parts protection, you might be protected in instance anything happens to the pricey specialty tools as well as components in your ownership. suvs.

Each insurance firm has Homepage its very own collection of policies, but they usually share a couple of common variables. Autos must be at least a decade or more old to be qualified for a classic automobile insurance coverage plan, in some cases a lot more - dui. Some newer cars might certify as collector cars, but these are the exemption, not the rule. car.

Some insurance companies will put a yearly mileage limit on your car; others have a listing of uses specifically forbidden, such as travelling to function. Some insurance companies require you own a key auto for your everyday use to guarantee that is not your function for the classic automobile - cheap auto insurance. Vintage car insurance companies wish to see that you are taking good care of your vehicle.

Teenager vehicle drivers and young grownups tend to have greater crash prices than older, much more knowledgeable vehicle drivers. You might have to go to least 25 years old to guarantee a classic automobile. While you may still have the ability to get classic automobile insurance coverage with a less-than-perfect driving record, motorists with tidy driving documents will generally pay reduced prices.

Classic Car Insurance In Florida - Getjerry.com Can Be Fun For Everyone

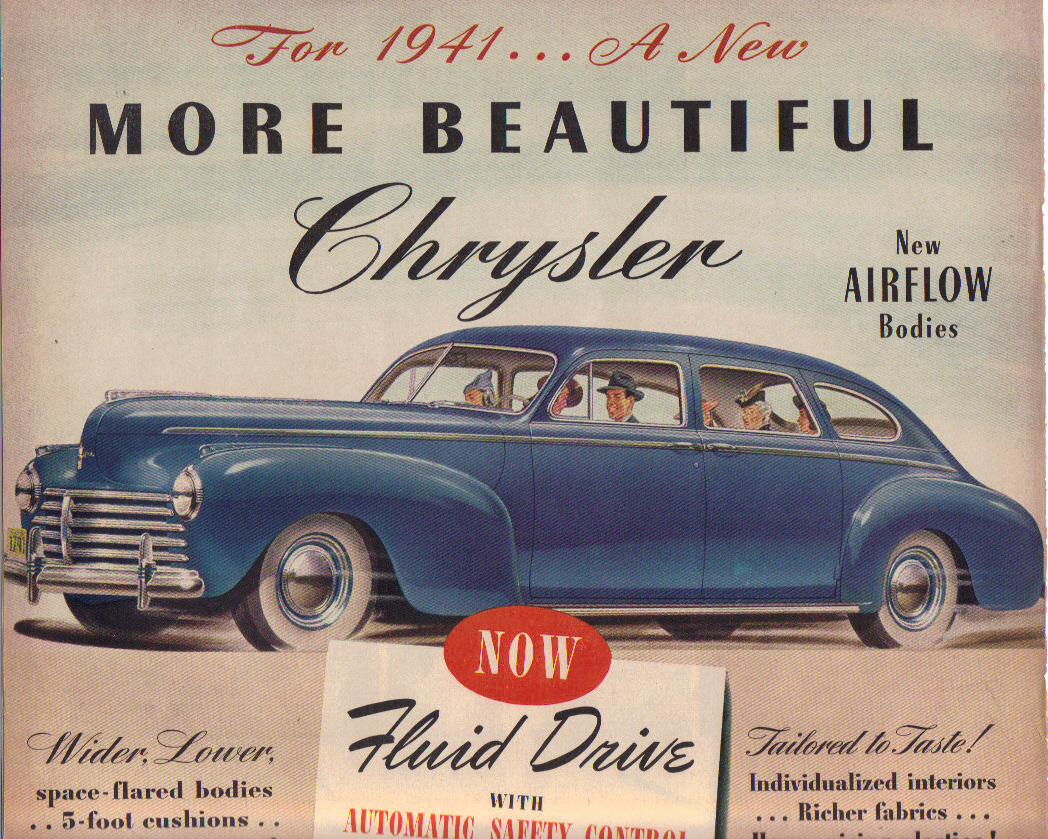

Just how to obtain a traditional cars and truck insurance coverage quote, As soon as you're prepared to start looking around and also compare car insurance policy estimates, it may be handy to have the following details conveniently available. It is very important to apply the same info to all insurance firms to get quotes that are easy to compare. You need to understand the make and model of your vintage car as well as the year it was initially built.

Assume regarding just how lots of miles you plan to drive your vintage car each year - low-cost auto insurance. It needs to normally be a reduced number, typically under 5,000 miles. Lots of timeless automobile insurance providers have gas mileage limits you'll need to bear in mind. Have there been any kind of modifications made to the lorry? Do you prepare to make any type of yourself? These are all concerns that insurers will likely want the solution to, because they can significantly impact the value of the cars and truck.

Locks and also security system might assist reduce your insurance policy costs, while saving the auto outdoors or anywhere with low defense will drive prices higher or invalidate you entirely from protection. vehicle insurance. Your insurance coverage company ought to be able to seek out your driver background to inspect for accidents and also infractions - cheapest auto insurance. If you're not exactly sure what your chauffeur history resembles, contact your neighborhood DMV for a copy of your driving record prior to getting quotes.

The majority of insurance policy specialists recommend obtaining at least 3 quotes from different carriers. Just how much is vintage car insurance coverage? Just like standard automobile insurance coverage, just how much your costs will certainly be depends upon a variety of aspects, some related to the auto and some pertaining to the chauffeur - cheapest car insurance. Some variables that might influence your auto insurance cost, depending upon your state, are the age of the lorry, the value of the lorry, the age of the chauffeur, the sex of the vehicle driver, the vehicle driver's driving document, credit history as well as more.

The Main Principles Of Classic Car / Collector Car Insurance - 281-998-2500

insurance companies vehicle insurance car insurance cheapest auto insurance

insurance companies vehicle insurance car insurance cheapest auto insurance

You need to make inquiries with the insurance provider to see if this is something they provide. cheapest car insurance. Some service providers that do offer this option are Chubb, PURE, Cincinnati Insurer as well as AIG Private Customer."Frequently asked inquiries, How is vintage car insurance various from routine automobile insurance policy? Classic automobile coverage is designed for the special needs of vintage car proprietors.

affordable car insurance car cheaper auto insurance money

affordable car insurance car cheaper auto insurance money

Putting the time and also initiative right into restoring an antique or traditional automobile can be satisfying, both personally as well as financially. Even though they're commonly driven only on unique occasions, such automobiles can easily appreciate in value particularly if they are kept in roadworthy condition and are limited to seasonal usage. The last thing you desire is to have all your hard work go to waste. cheap auto insurance.

affordable car insurance cheap auto insurance auto risks

affordable car insurance cheap auto insurance auto risks

Call a HUB broker to begin. insurance company.

insured car cars cheap auto insurance suvs

insured car cars cheap auto insurance suvs

The minimal use stipulation of a classic automobile policy permits for traveling to car programs as well as car club meet-ups; however, this coverage may be limited by some insurance companies - dui. If this is the case, there are insurance companies that can provide specific protection for vehicle shows and conferences. Before selecting a timeless vehicle insurance company, it deserves examining whether they have travel constraints if you intend to take your automobile on normal, multi-day, high mileage drives - cheap insurance.

The Only Guide to The Best Classic And Collector Car Insurance Companies

This value will certainly be defined in your policy and your vehicle will be covered to that value without devaluation. Keep in mind that, unlike everyday automobiles that decrease with time as you include miles to them, timeless vehicles may acquire value. Ensure you adjust your insurance coverage as the value of your car values.

Insurance coverage for lugging is appropriate with the unique needs of carrying a traditional vehicle. Extra components protection, also, needs to be aligned with the price of changing beneficial and probably hard-to-find vehicle elements, such as wheels, transmissions, as well as engine parts (affordable auto insurance).

What is the difference between predetermined worth and also stated worth insurance coverage? An agreed value policythe like a Surefire Value plan through Hagertyguarantees that you will obtain the full insured amount of the lorry (without depreciation, and also including all sales taxes), in case of a covered total loss.

Also if you have full protection with a normal vehicle insurance service provider, there might be mileage and use restrictions to control how and also when your standard is driven. insurance companies. There are a number of much more benefits vintage car plan holders appreciate, see our Contrast to Daily Vehicle Driver Insurance Policy section to see some more (affordable).